Canada Revenue Agency Income Tax Tax Fraud

by admin

Comments Off on TAX Refund SCAM Warning

TAX Refund SCAM Warning

Time is counting down to file your income tax return by April 30th. Already many of you have filed your tax return and anxiously waiting for the tax return to be processed and refund either come into mail or directly deposited to your bank account with CRA records.

Unfortunately scammer are taking account of this dire situation and pulling out all their tricks to steal your identity information. A tax return contains the most private information about you. You can only get access to that information through CRA secured web site and logging into your “MY ACCOUNT”.

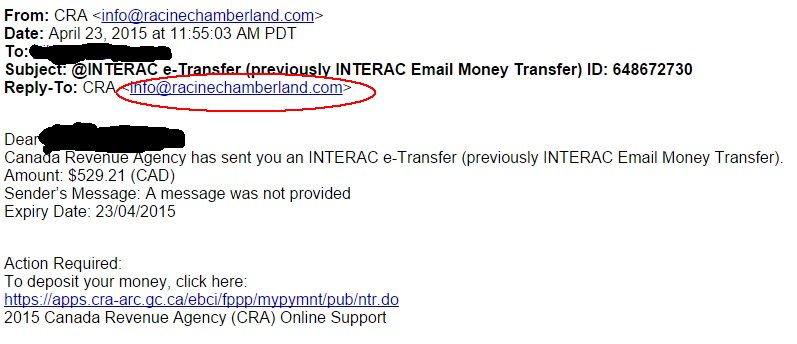

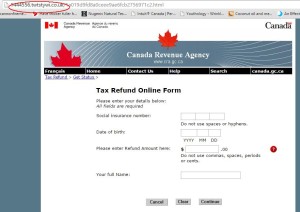

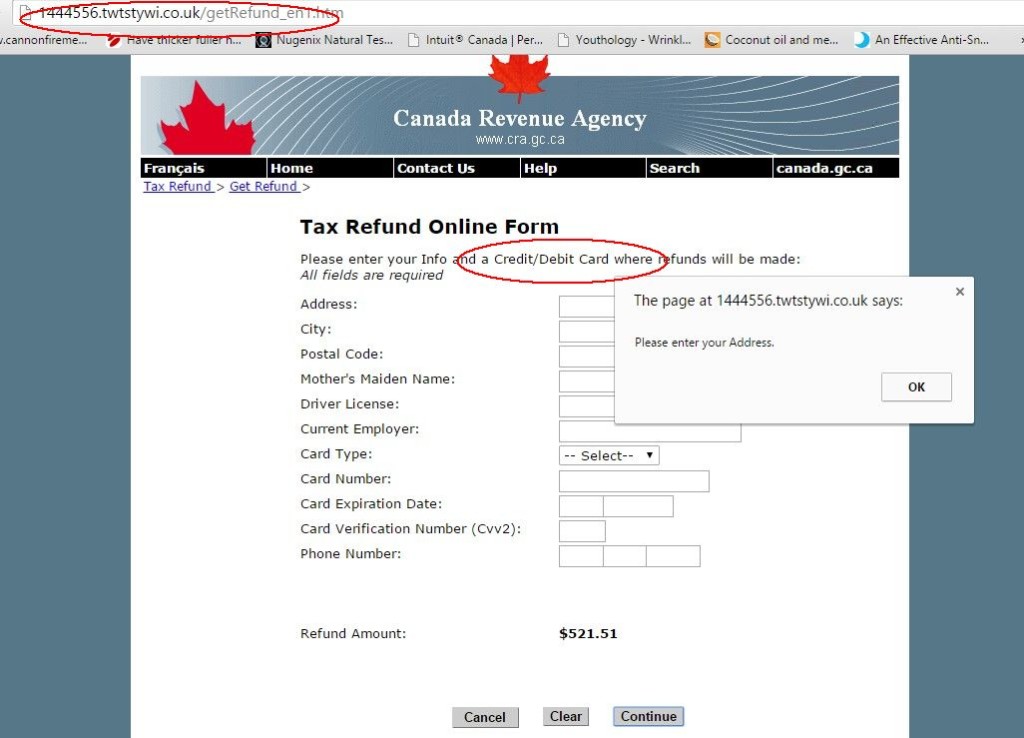

This phishing scheme just came to my attention. Scammers are sending a fake email informing that CRA is sending them their refund by email money transfer. The fraud scheme seems to be highly sophisticated. They have the CRA banner with actual link to CRA web sites. The Form looks very similar to CRA on line forms. But the URL gives out that it is not a CRA website.

For your identity protection and security reason, do not send any information through CRA website. Use snail mail or call them direct.

Income Tax Real Estate Tax Fraud

by admin

Comments Off on Tax Avoidance Scheme By Prince Charles

Tax Avoidance Scheme By Prince Charles

Every wealthy person and successful companies are engaged in legitimate tax deduction all over the world. “Only little people pay tax”.

Supposed tax avoidance has been a hot topic in Britain and the U.K. government has gone after corporate giants such as Google, Amazon and Starbucks, alleging they have all found ways of not paying tax.

They recently focused their attention on the tax deduction strategy of Prince Charles.

According to reports Prince Charles has a complicated business holding comprised of agricultural, commercial and residential lands in U.K. under a holding company called Duchy of Cornwall. The assets of the holding company are valued at $1.2 billion and it does not pay any income tax to the U.K. government. more »

Income Tax Tax Fraud

by admin

Comments Off on Lauryn Hill Sent To Prison For Past Taxes

Lauryn Hill Sent To Prison For Past Taxes

Grammy-winning singer Lauryn Hill has been sentenced to prison for failing to pay past taxes of about a $1 million. These tax debt owed to the IRS from her earnings as a singer between 2005-2007.

This is another show off by the IRS to send a message to the public by prisoning famous celebrities, the pitfalls of failure to pay taxes. Previous high profile celebrity jailed by IRS, was Wesley Snipes. Demand of past due taxes has compelled many celebrities to file for personal bankruptcy.

Hill pleaded guilty last year to three counts of failing to file tax returns between 2005 and 2007. Her tax debt on the earnings between those years was about $1.8 million. Before the sentencing, her attorney had said Hill had paid more than $970,000 to satisfy the state and federal tax liabilities. But she still owes about $1 million to the Federal and State government. more »

Canada Revenue Agency Income Tax Real Estate Tax Fraud

by admin

Comments Off on Canada Revenue Agency Wants to Tax Real Estate Investors 100%

Canada Revenue Agency Wants to Tax Real Estate Investors 100%

This could be scary news for Canada’s hot real estate market and real estate entrepreneurs. Canada Revenue Agency has launched a “Condo Project” to take a closer look at the income reporting of real estate investor in the condominium sector.

Taxation on gain from real estate income in Canada is collected at a preferred rate. That is why any one with savings prefers to invest in real estate. Here is how the income from Real Estate is taxed in Canada.

a). Profit from sale of a Principal residence is a tax free income; subject to you meet the criteria to claim that home as your principal residence.

b). Profit from sale of a Rental Property or Investment Property is treated as Capital gain under the Income Tax Act. As it’s a Capital Gain, taxpayer pays tax on only 50% of the income reported on the sale of an investment property. For Example, when you sold your property, if you had a profit of $100.000, 50% of that profit is taxable. So, if you are at 46% tax bracket, your tax on the profit will be $23,000. more »

Income Tax Tax Fraud

by admin

Comments Off on Accounting Improprieties at H.P. or a Tax Fraud?

Accounting Improprieties at H.P. or a Tax Fraud?

Major news is out today that H.P., had taken $8.8 billion accounting charge after discovering “serious accounting improprieties” and “outright misrepresentation” at Autonomy that it bought for $10 billion in 2011.The accounting charge essentially wiped out its profits (really? no 38% corp. tax to pay). Previously H.P. had taken an $11 billion charge related to its acquisition of Electronic Data System in 2008.

It sounds to me H.P. has become a victim of serial “Accounting Improprieties” wiping out any of its profits and putting the company in red on the books.

more »