Legal Tax Minimization – Unbelievable

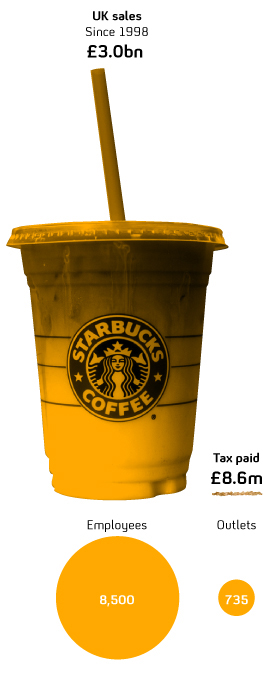

In UK Amazon, Google and Starbucks, internationally recognized brands are in hot seat for their cleaver use of accounting of tax minimization strategies.Lets review Starbucks tax bill which is a $40 billion company. Starbucks started their UK subsidiary in 1998. Since 1998, till 2011, Starbucks sales were over 3 billion UK pounds, opened 735 coffee outlets and paid taxes of 8.6 million pounds. Since 2009 Starbucks has paid no tax in UK.

Starbucks did not pay any tax, because it did not make any profit in UK

subsidiary. Which is interesting because, in their public calls to their creditors, investors and analyst Starbucks officials promoted the UK business as “profitable” and growing a model to follow in other countries.

Here is a chart of what other companies paying taxes in UK in last three years.

|

Company |

Sales |

Tax Paid |

|

Starbucks |

1.2 Billion Pounds |

0 |

|

McDonald’s |

3.6 Billion Pounds |

80 Million Pounds |

|

KFC |

1.1 Billion Pounds |

36 Million Pounds |

Starbucks global chief financial office Troy Alstead said that the company had a special tax arrangement with the Dutch government on its European headquarters. “It’s a favourable tax rate that we have in the Netherlands,” he admitted.

Google later confirmed that it used low tax rates in the Republic of Ireland for the same reason, while Amazon’s sales are operated from Luxembourg.

Watch these news clips to really understand how it is legal to minimize the tax even to some it might be immoral.

What are you doing to minimize your tax?