Income Tax

by admin

Comments Off on Mitt Romney Pays 15% Tax on His $10 Million Dollar Annual Income

Mitt Romney Pays 15% Tax on His $10 Million Dollar Annual Income

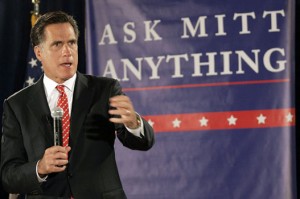

Ask Mitt Romney anything, just not about his personal income tax. That is the answer from his campaign office and the candidate himself in response to making public his 2010 Income Tax Return.

But he is ready to open his 2011 income tax return when it’s done and filed in April of 2012.

Warren Buffet, the nation’s leading investment guru with a net worth of $39 billion, has lamented the fact that he pays an effective tax rate below that of his secretary. Mitt Romney, the overwhelming favorite to win the Republican nomination, estimated his effective tax rate on the income generated by his $250 million fortune is “probably closer to the 15 percent rate than anything.”

Mitt Romney reported that his personal net worth is about $250 million and a significant asset of the Romney family is owned by his wife, who does not have to report her net worth or her personal income tax return.

Romney’s money managers would have to be bad at their jobs if his income doesn’t soar well above $10 million a year. No doubt, reporters and the public will tear through the return for evidence of where it came from.

The vast majority of the income Mr. Romney reported over 12 months in 2010 and ‘11 was dividends from investments, capital gains on mutual funds and his post-retirement share of profits and investment returns from Bain Capital, the firm he once led rather than ordinary income, or rather than earned annual income. And Mr. Romney also noted that he made hundreds of thousands of dollars from speaking engagements.

The Income Tax Return when made public could reignite the debate over the tax treatment of so-called carried interest, where the million dollars of income earned by private equity managers like Romney is taxed at the 15 percent capital gains rate instead of the maximum 35 percent rate levied on personal income.

Income generated from capital gains, are treated differently because it is assumed it is a return on capital put at risk in productive investments, which generate jobs and income for other Americans. However they are viewed, most capital gains in the U.S. are earned by people in the wealthiest 1 percent of the population, and a growing share of U.S. income comes from earnings on invested capital (capital gains, interest and dividends) rather than from wages and salaries.

So, a hard working American who is earning wages and salaries by working day in and day out, paying a higher percentage on their income in taxes than the Candidate Mitt Romney who is legally paying the minimum tax on his $10 million annual income. How about that? Isn’t that a fantastic tax planning by the Candidate?