Income Tax: Tax Payer

by admin

Comments Off on Another Tax Grab by Government Foiled by Indian Small Business Owners

Another Tax Grab by Government Foiled by Indian Small Business Owners

Indian Finance Minister Pranab Mukherjee announced on March 16th that non-branded gold jewelry will be taxed at a rate of one-per-cent for the first time in the country.The minister also raised the import duty on gold for a second time this year as part of measures to rein in the current account deficit, partly stoked by record bullion purchases. The precious metal has been climbing for a 12th year as the sovereign-debt crisis in Europe and concerns that global economic growth may slow spurred demand for a protection of wealth.

Mukherjee raised the import duty on gold bars and coins and platinum to four per cent from two per cent, after doubling the tax in January.

more »

Income Tax: Canada Real Estate Tax US Tax

by admin

Comments Off on US Tax Grab Is Targeted At Canadian Real Estate Investors

US Tax Grab Is Targeted At Canadian Real Estate Investors

US Federal and State agencies are starving for Tax Revenue and facing the choice of bankrupting the State Governments.Canadians, have been investing at an increasing rates in the US rental and vacation properties since the US housing market took a dive in price in 2008.

IRS tax law for off-shore investors (Canadians) states that, gross rental property income should be taxed at source @ 30% rate by the property management company and remitted to the IRS each month. Only filing a Non Resident USA tax return, Canadians can get back some of the rental income deducted at source. Since most Canadian does not have any mortgage, they cannot claim mortgage interest expense against their rental income, and almost 100% of the income is taxable in USA.

more »

BC Province Property Tax

by admin

Comments Off on Vancouver Residents Are Just a Money Dispensing Machine

Vancouver Residents Are Just a Money Dispensing Machine

You reap what you sow.I just love this phrase.

Vancouver residents cheerfully re-elected their Mayor in last election. Re-election of an incumbent Mayor means, you fully approve of his past actions and commited to his future actions and policies.

So, here we go again. Press the button of property owners and get some more money out of them. While the recession means tightening the budget and cutting expenses, it means a whole different thing for the Vancouver City Council.

We need more police force, while we do not have money at the moment. The city budget is already $52 million in deficit.

more »

Income Tax: audit Income Tax IRS US Tax

by admin

Comments Off on 2012 Offshore Voluntary Disclosure Initiative Announced by IRS

2012 Offshore Voluntary Disclosure Initiative Announced by IRS

If you have to file US tax returns, doing nothing is no longer an option. You have to file a US Tax Return, if you are,1. A USA Citizen

2. A Dual USA Citizen Living Abroad

3. A USA Resident

4. A USA Green Card Holder Living Abroad

United States Internal Revenue Service (IRS) has been aggressively pursuing US persons (including US citizens and green-card holders living abroad) who have failed to report foreign income on their US income-tax returns and/or failed to report foreign bank and investment accounts on a Foreign Bank Account Report (FBAR). A US Person, must file income tax return with IRS, regardless of their residency.

IRS implemented amnesty programs since 2009 for US citizens to come forward with their foreign income reporting. More than 30,000 people have voluntarily complied since 2009, at least 30 have been criminally indicted and the IRS has netted a total of $4.4 billion in unpaid taxes, interest and penalties.

The State Department estimates that more than 6 million citizens live overseas, excluding those in the military, yet the IRS receives only 1.6 million tax returns each year with foreign addresses. And just over 500,000 FBARs were filed in 2009.

On January 9, 2012 the IRS announced a third amnesty, formally known as the Offshore Voluntary Disclosure Program. It is substantially the same as the 2011 amnesty (aka 2011 OVDI), with some exceptions:

more »

Income Tax

by admin

Comments Off on Mitt Romney Pays 15% Tax on His $10 Million Dollar Annual Income

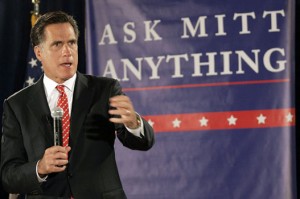

Mitt Romney Pays 15% Tax on His $10 Million Dollar Annual Income

Ask Mitt Romney anything, just not about his personal income tax. That is the answer from his campaign office and the candidate himself in response to making public his 2010 Income Tax Return.

But he is ready to open his 2011 income tax return when it’s done and filed in April of 2012.

Warren Buffet, the nation’s leading investment guru with a net worth of $39 billion, has lamented the fact that he pays an effective tax rate below that of his secretary. Mitt Romney, the overwhelming favorite to win the Republican nomination, estimated his effective tax rate on the income generated by his $250 million fortune is “probably closer to the 15 percent rate than anything.”

Mitt Romney reported that his personal net worth is about $250 million and a significant asset of the Romney family is owned by his wife, who does not have to report her net worth or her personal income tax return.

Romney’s money managers would have to be bad at their jobs if his income doesn’t soar well above $10 million a year. No doubt, reporters and the public will tear through the return for evidence of where it came from.

more »