Income Tax: Real Estate Tax Tax

by admin

Comments Off on Vancouver’s Tax Payers are on the Hook for Olympic Village

Vancouver’s Tax Payers are on the Hook for Olympic Village

Vancouver City Mayor Gregory Robertson announced that the city Taxpayers might suffer a loss on the sale of Olympic village condos.

Where as news reports are announcing that real estate price is going up all over Canada, it seems the developers of the Olympic condo complex having a difficult time to find buyers for their highly inflated priced, state of the art green tech residential complex.

City of Vancouver is on the hook for $1 billion in the development of the Olympic condo complex.

City loaned the money to the condo developer and was hoping to get it back, by the sale of condo in the complex, after the Olympic is over.

It has been eight months since the Olympic ended and the condos are still not sold, because the price is too high.

Developer Millennium is negotiating with the City to reduce the price of the condos to move them

Unfortunately, if the condos are sold at a reduced price, Vancouver city will not be able to recover the $1 billion tax payer’s money, invested in the project.

The Mayor said, “It’s impossible to predict now. The challenge is if sales don’t make it and the city can’t recoup the gap from Millennium’s asset base, then there is a loss.”

The Olympic Village Condo Complex has become a “White Elephant” for the City of Vancouver. The city had problems with finding Management Company of the complex. Early buyers are trying to back out off their contract. Several open house failed to attract new buyers.

Our Tax Money At Work.

Canada Revenue Agency Income Tax: CRA payroll tax Tax Rate

by admin

Comments Off on Annual Contribution to CPP is Raised to $185 a Month

Annual Contribution to CPP is Raised to $185 a Month

The CRA has increased the maximum pensionable earnings to $48,300. There is a CPP exemption on earnings up to $3,500. You do not pay any CPP if your annual earning is $3,500. The current CPP rate is 4.95% for both the employer and employee.

Since the CPP premium rate is unchanged, and the pensionable earnings went up, net CPP is up for both employees and employer. Maximum CPP premium will be $2,217.60 for employees and $4,435.20 for the self employed annually.

From Jan 1, 2011 EI premium is going up also.

So, expect to see a smaller pay cheque if your earnings remains the same in 2011.

BC Province HST Income Tax: Canada Tax

by admin

Comments Off on HST and Income Tax Causing Fall of Empires

HST and Income Tax Causing Fall of Empires

History repeating again. Mighty rulers of empires have fallen many times over this.

Your subjects do not like to be taxed.

Yesterday, it was Obama, got a dose or reality. America’s infatuation over change has faced the new reality, that nothing changed for over two years.

Today it’s British Columbia. The Premier could not stop the tide of discontent of Province’s people by giving a soothing lecture last week and cutting income tax.

In BC, people do not like HST to being with, and more than that, how it was implemented and imposed on BC.

Simply put, it has blind sided every common people in BC.

There were no public input, no advance sign and no discussion about the benefits of HST on overall economy.

The Liberals have failed massively to get any support for HST.

The Premier in his resignation speech mentioned about personal attack, and the cause of stepping down as BC Premier.

Well, it was his personal decision to implement the HST as the way it got implemented.

He must take responsibility.

Cheers for the people of British Columbia. More power to you.

Income Tax: Canada IRS US Tax

by admin

Comments Off on U.S. Tax Revenue To Take A Dive With This Election Result

U.S. Tax Revenue To Take A Dive With This Election Result

After largely getting rejected by the US voters on midterm election, the U.S. President came out with the first compromise on Income Tax for middle class families.

In his after election defeat press conference, He said that he will work with the Republican controlled Congress to keep the tax increase at a minimum for middle class families. There is still the issue of Tax Increase of upper-income families.

The President was ready to let expire the Bush tax cut on Upper-income families

With the Congress now under the republican control, it will be next to impossible without some major compromise on other issues for the Democrat President to expire the Bush tax cut.

What it mean on the macro level for U.S. economy?

It is already being called scary. The current U.S. deficit is on a rising trend and is at US$200 trillion. If U.S. was a corporation, it would have been declared bankrupt.

Since the Tax increase is going to be rejected and blocked by the Congress, there is no way U.S. will be able to reduce the deficit to a more manageable level. Instead it will keep ballooning.

As soon as other countries will realize the dire situation the U.S. economy is in, they will refuse to do business with U.S.

Would you like to give credit to a Bankrupt company? Do the Banks give credit to a Bankrupt person?

How would you like to do business with a Bankrupt U.S.?

U.S. will bear the burden of this midterm election for a long long time.

Income Tax: investment US Tax

by admin

Comments Off on Tax Incentive to Start US Economic Engine

Tax Incentive to Start US Economic Engine

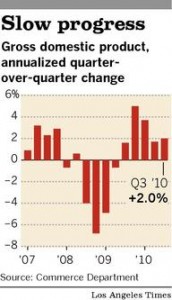

US quarterly GDP data released by Commerce Department showed a modest 2% growth in the third quarter of the year.The recession was over a year ago, but the economy has not shown enough steam to move ahead to stimulate job and spending growth.

GDP data is showing a continued existence of unemployment, spending contraction, poor business environment and housing market, which will continue to inflict pain of recession on the US economy.

This brings us to the inevitable tax changes on the personal and business income in 2011. It is pretty much confirmed, in US people making over $250,000 will bear a higher tax burden in 2011.

With the GDP results, US President Obama, tried to gain support for his proposal for accelerated tax write-offs for business investments for equipment.

Reason being, businesses will invest in new equipments, hire skilled workers and increase productivity and save on income tax.

But smart businesses will look at the GDP data and the future outlook is not rosy enough for them to beef up productivity and start hiring, just to increase stored inventory.

This time, sustained economic recovery’s main catalyst is real recovery in the labor market. Until people have jobs and businesses gets confidence to hire new employees, US is faced with a continued slow or negative growth in the economic recovery from recession.

After spending increase in this holiday season, the first quarter of 2011 GDP is expected to contract and nose dive confirming, US businesses does not have confidence in published economic recovery news in the media or by the politicians.