BC Province Canada Revenue Agency HST Income Tax Networking

by admin

Comments Off on What is TAX?

Leaving France To Lower Tax

French president François Hollande’s plans to introduce a supertax of 75% on all income over one million, got many French rich and famous people to leave their country and surrender their French passport.One of the world’s most famous Frenchmen, Gérard Depardieu, is in the process of giving up his French passport and is now a Russian, after Vladimir Putin personally granted him citizenship on 3rd January.

It’s fairly clear the main attraction of Depardieu’s new domicile is its 13% flat income tax rate, since the actor has been flamboyantly fulminating for ages about French president François Hollande’s plans to introduce a supertax.

more »

2012 Year End Tax Planning

So, you are busy with eating, drinking and shopping now, forgetting all about the dreaded tax year deadline of December 31st, 2012.Would you believe all your shopping expenses can be paid of by your tax refund if you pay attention to your tax planning in today. Now is a good time to take advantage of tax credits and deductions and leave more money in your wallet and less on your 2012 tax bill. Money to pay your bills.

Tax planning a year round activity. Its not a last minute Christmas shopping like activity. If you act before the year end, you can reduce your tax bill by thousands of dollars.

This survey result is like Christmas present to the CRA. H&R Block found in a survey that 30% Canadians are planning to do something before the end of the year to help with their 2012 returns. 36% say they have no plans and 29% have not thought about it.

more »

Legal Tax Minimization – Unbelievable

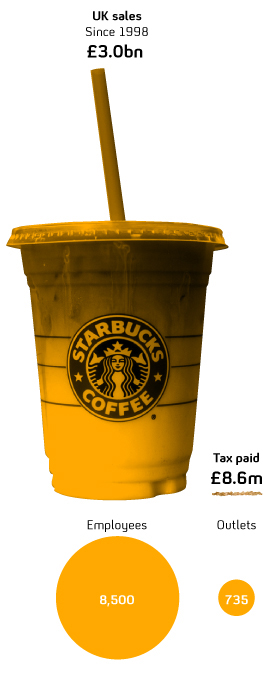

In UK Amazon, Google and Starbucks, internationally recognized brands are in hot seat for their cleaver use of accounting of tax minimization strategies.Lets review Starbucks tax bill which is a $40 billion company. Starbucks started their UK subsidiary in 1998. Since 1998, till 2011, Starbucks sales were over 3 billion UK pounds, opened 735 coffee outlets and paid taxes of 8.6 million pounds. Since 2009 Starbucks has paid no tax in UK.

Starbucks did not pay any tax, because it did not make any profit in UK

subsidiary. Which is interesting because, in their public calls to their creditors, investors and analyst Starbucks officials promoted the UK business as “profitable” and growing a model to follow in other countries. more »