Income Tax: Tax Tax Payer US Tax

by admin

Comments Off on How To Pay Zero Tax On Your Billion Dollar Profits

How To Pay Zero Tax On Your Billion Dollar Profits

A little known tax law used by most businesses and tax advisors to pay zero-tax. This is applicable to both Canadian and USA businesses.You can pay zero tax or no tax by applying your current year profits to offset your past year losses.

It was reported last week that General Motors paid no federal income tax for 2011 on profits of $7.6 billion, which was $3 billion more from the previous year. GM has earned more than $13 billion in profits since 2009, when it received a massive $49.5 billion bailout.

“We did not pay federal income tax last year,” said GM spokesman Jim Cain. The Detroit News, who broke the news, also quoted Cain as claiming GM would not have to pay federal taxes “for many more years.”

more »

Income Tax: Income Tax Tax Tax Payer

by admin

Comments Off on If You Can’t Tax The Poor Tax Their Food

If You Can’t Tax The Poor Tax Their Food

Its hard to believe what the government will do to collect tax.

This is the new tax collection policy starting in Britain. In March, British Prime Minister David Cameron laid out plans to tax Cornish pasties and other snacks, a move critics say will hit working families at a time of economic hardship.

The British government has been embroiled in the “Pasty Tax” row since it announced plans to close a loophole that allows bakeries in Britain to serve hot takeaway food without incurring 20% value-added tax.

The items include pies, sausage rolls and pasties – a traditional delicacy eaten for centuries by miners in the southwestern English county of Cornwall, which consists of meat and vegetables in a pastry crust.

Greggs bakeries, a purveyor of fast-food, including 140 million sausage rolls per year, saw its shares slump 5.5 percent last week on news of the new tax.

more »

Income Tax: Green Card IRS US Tax

by admin

Comments Off on Americans Living Abroad Are Acting Like Superman

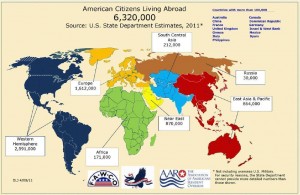

Americans Living Abroad Are Acting Like Superman

A year ago, in Action Comics, Superman declared plans to renounce his U.S. citizenship.

Now, I did not know that. But a year ago, I advised few of my clients that renouncing their American citizenship might be the only way to keep IRS and USA government off their back.

According to a news report, in 2011, almost 1,800 people followed Superman’s lead, renouncing their U.S. citizenship or handing in their Green Cards. That’s a record number since the Internal Revenue Service began publishing a list of those who renounced in 1998. It’s also almost eight times more than the number of citizens who renounced in 2008, and more than the total for 2007, 2008 and 2009 combined.

more »

Income Tax: Canada US Tax

by admin

Comments Off on In Ontario, Canada Super Rich are now the Super Villains

In Ontario, Canada Super Rich are now the Super Villains

If you live in Ontario and one of 23,000 Ontarians who is making over $500,000 you are branded as Super Rich by the

Politicians and are expected to pay 2% more surtax on your income. At the highest income bracket, Ontarians currently pay roughly 46.5 per cent in provincial and federal taxes combined.The new tax would move Ontario income tax rate to 48.5 per cent for the Super Rich.

more »

Income Tax

by admin

Comments Off on 2011 USA Income Tax Filing Deadline Is April 17, 2012

2011 USA Income Tax Filing Deadline Is April 17, 2012

USA income tax filing deadline is approaching soon. The Internal Revenue Service opened the 2012 tax filing season to report taxpayers’ 2011 income and pay taxes by announcing that taxpayers have until April 17 to file their tax returns which is just about a week away.

more »