Canada Revenue Agency Income Tax: audit Canada CRA Property Tax

by admin

Comments Off on Canada Revenu Agency Audit is Up This Year

Canada Revenu Agency Audit is Up This Year

Canada Revenue Agency audit is up significantly for tax payers all across the board. And if you are a self employed or independent contractor, you are more likely to be audited to provide proof of certain expense deduction claims. It is very important to have not only sufficient but 100% backups of expense claims with original documents or third party proof. Here are some of the expense deductions that CRA is primarily auditing from Canadian Tax Payers. If you have any of these deductions in your 2012 tax returns, you could be asked to provide supporting documents to support your claim.1. Education/Tuition fees expense.

2. Transfer of Tuition fees to spouse or parents.

3. Professional Membership dues

4. Donation Claim receipts

5. Medical expense claims

more »

Income Tax: Canada US Tax

by admin

Comments Off on In Ontario, Canada Super Rich are now the Super Villains

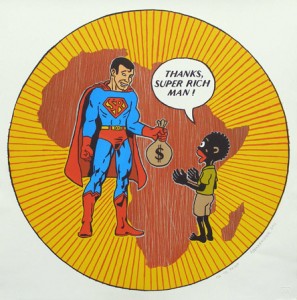

In Ontario, Canada Super Rich are now the Super Villains

If you live in Ontario and one of 23,000 Ontarians who is making over $500,000 you are branded as Super Rich by the

Politicians and are expected to pay 2% more surtax on your income. At the highest income bracket, Ontarians currently pay roughly 46.5 per cent in provincial and federal taxes combined.The new tax would move Ontario income tax rate to 48.5 per cent for the Super Rich.

more »

Income Tax: Canada Real Estate Tax US Tax

by admin

Comments Off on US Tax Grab Is Targeted At Canadian Real Estate Investors

US Tax Grab Is Targeted At Canadian Real Estate Investors

US Federal and State agencies are starving for Tax Revenue and facing the choice of bankrupting the State Governments.Canadians, have been investing at an increasing rates in the US rental and vacation properties since the US housing market took a dive in price in 2008.

IRS tax law for off-shore investors (Canadians) states that, gross rental property income should be taxed at source @ 30% rate by the property management company and remitted to the IRS each month. Only filing a Non Resident USA tax return, Canadians can get back some of the rental income deducted at source. Since most Canadian does not have any mortgage, they cannot claim mortgage interest expense against their rental income, and almost 100% of the income is taxable in USA.

more »

Income Tax: Canada Green Card IRS US Tax

by admin

Comments Off on IRS Calling! US Citizens in Canada File Your Tax Return

IRS Calling! US Citizens in Canada File Your Tax Return

Call Us NOW, Before IRS Calls You! or You might face hefty penalties or even prison time.The USA tax collector Internal Revenue Service (IRS) has stepped up their search for U.S. citizens living outside of the country and not filing their returns.

Thousands of “lost” U.S. citizens living in Canada are getting the call from the IRS.

Here are some tips on how to get caught up:

*Dual citizens: Even if you moved to Canada and became a citizen or resident, unless you go through the formal process of renouncing your U.S. citizenship, you are considered a dual citizen. The IRS still expects you to file your annual income tax return form 1040.

more »

BC Province Canada Revenue Agency HST Income Tax: Canada CRA Income Tax

by admin

Comments Off on How to Read Notice of Assessment and Reply to Request for Documents

How to Read Notice of Assessment and Reply to Request for Documents

Canadians tax filing deadline has passed on April 30th, 2011. And if you are one of those who have filed their tax return on time, you have probably got back your refund or if you owed taxes, paid your tax bill by now, to avoid penalties and interest.

You also probably got a Notice of Assessment from Canada Revenue Agency, explaining, how much carry forward you have for the next tax year and what is your TFSA and RRSP contribution limits for the next tax year. NOA is a very important document for you to understand and keep in file. If you do not agree with the NOA, you must file your objection in due time. If you fail to file your objection to CRA’s NOA, by law you are obligated to abide by the NOA information and data. Get help of your Tax Advisor to understand your NOA.

If your tax return was a bit complicated and you have lots of medical, tuition expense, business loss, etc., CRA will not send you a NOA. CRA will send you a 4 to 9 page letter, requesting supporting/additional documents to support your deduction claims. This letter is usually sent from CRA’s preassessment review section.

more »