Income Tax: investment

by admin

Comments Off on Why Borrowing to Invest in RRSP is a Bad Idea?

Why Borrowing to Invest in RRSP is a Bad Idea?

RRSP season is coming.

You still have two more months to top up your RRSP contribution. If you have fully used up your RRSP contribution room for 2009, your 2010 RRSP contribution limit will be 18% of your 2009 earned income to a maximum of $22,000. You might have more contribution room if you have unused RRSP from previous years.

RRSP is a tax deferred investment. You do not pay any tax on your RRSP contribution as long as you keep your investment in your RRSP account. Once you start to withdraw money from your RRSP account, it become fully taxable during the year it is withdrawn, except for Home Buyer Plan. HBP is like taking a loan from your RRSP account and you must pay it back. If you do not repay and fill up your RRSP account, unpaid amount is included in your income and is taxable.

more »

Grant: investment Tax Payer

by admin

Comments Off on Canada’s Economy Still Need Stimulus

Canada’s Economy Still Need Stimulus

So, all the economic news about the resilient economy of Canada in this world wide recession is over?

According to Bank of Canada, the economy is suffering from low productivity and high Canadian dollar with resulting falling exports.

In a statement the Bank of Canada said “The global economic recovery is proceeding largely as expected, although risks have increased.”

I cannot justify the above positive statement by what the bank said afterwards which is closer to the reality of global economy.

more »

Income Tax: investment US Tax

by admin

Comments Off on Tax Incentive to Start US Economic Engine

Tax Incentive to Start US Economic Engine

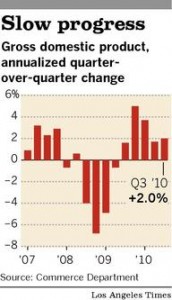

US quarterly GDP data released by Commerce Department showed a modest 2% growth in the third quarter of the year.The recession was over a year ago, but the economy has not shown enough steam to move ahead to stimulate job and spending growth.

GDP data is showing a continued existence of unemployment, spending contraction, poor business environment and housing market, which will continue to inflict pain of recession on the US economy.

This brings us to the inevitable tax changes on the personal and business income in 2011. It is pretty much confirmed, in US people making over $250,000 will bear a higher tax burden in 2011.

With the GDP results, US President Obama, tried to gain support for his proposal for accelerated tax write-offs for business investments for equipment.

Reason being, businesses will invest in new equipments, hire skilled workers and increase productivity and save on income tax.

But smart businesses will look at the GDP data and the future outlook is not rosy enough for them to beef up productivity and start hiring, just to increase stored inventory.

This time, sustained economic recovery’s main catalyst is real recovery in the labor market. Until people have jobs and businesses gets confidence to hire new employees, US is faced with a continued slow or negative growth in the economic recovery from recession.

After spending increase in this holiday season, the first quarter of 2011 GDP is expected to contract and nose dive confirming, US businesses does not have confidence in published economic recovery news in the media or by the politicians.

Canada Revenue Agency Income Tax: CRA investment

by admin

Comments Off on Annual Report of Taxpayers Ombudsman

Annual Report of Taxpayers Ombudsman

Taxpayer’s Ombudsman created little over 2 years ago to provide and independent and impartial review of individual taxpayer complaints as well as addresses any widespread service-related issue at the CRA.

As a Canadian Taxpayer if you feel like you are being mistreated by the CRA, you can take your complain to Taxpayer’s Ombudsman.

On behalf of Taxpayers, the Ombudsman will take the complaint to CRA and ask for an investigation. In some cases the result of investigation might be favourable to the taxpayer.

The Ombudsman has filed its second annual report of annual activities on October 7, 2010. The report details the cases they have intervened on behalf of the taxpayers.

You can download the annual report here.

Canada Revenue Agency Income Tax: CRA investment Tax Rate

by admin

Comments Off on Tax Relief for Canadian Small Business

Tax Relief for Canadian Small Business

-

Computer cost:

The Government of Canada using Taxpayers money is starting an advertising campaign promoting the 100% capital cost allowance for computers.

“We know it is important for Canadian businesses to remain competitive in today’s changing world,” said The Honourable Keith Ashfield, Minister of National Revenue, “That’s why our Government brought in measures like this one, and many others in Canada’s Economic Action Plan. These temporary measures will help Canadian businesses through this challenging economic time, and make sure they have the tools they need for the future.”

Announced in Canada’s Economic Action Plan, this temporary tax relief measure allows Canadian businesses to claim a 100% capital cost allowance deduction for eligible computer hardware, including systems software, acquired after January 27, 2009, and before midnight, January 31, 2011.

The CCA rate for computer was increased from 55% to 100% with no half year rule in 2009, as a result a full write-off can be claimed in the first tax year that CCA deductions are available.

-

Apprenticeship:

A corporation can earn an input tax credit equal to 10% of the eligible salaries and wages paid to eligible apprentices employed in the business in the tax year and after May 1, 2006, to a maximum credit of $2,000, per year, per apprentice.

An eligible apprentice is one who is working in a prescribed trade in the first two years of their apprenticeship contract. This contract is registered with Canada or a province or territory under an apprenticeship program designed to certify or license individuals in the trade. A prescribed trade will include the trades currently listed as Red Seal Trades.

-

Tax Credit for Child Care Space:

An employer carrying on business in Canada, other than a child care services business, can claim a non-refundable tax credit to create one or more new child care spaces in a new or existing licensed child care facility for the children of their employees and for other children in the community. The non-refundable tax credit is equal to the lesser of $10,000 or 25% of the eligible expenditure incurred after March 18, 2007, per child care space created. Eligible expenditures include the cost of depreciable property (some exclusion apply), and the amount of specified start-up costs, acquired or incurred only to create the new child care space at a licensed child care facility.

-

Small Business Tax Deduction:

For Canadian-controlled private corporations claiming the small business deduction, the net federal tax rate is 11% effective January 1, 2008, down from 12%. The annual amount of active business income eligible for the reduced rate (referred to as the small business limit) was increased from $400,000 to $500,000, effective January 1, 2009.

Corporation Tax Rate Reduction:

The corporation net federal tax rate will decrease as follows:

18% effective January 1, 2010;

16.5% effective January 1, 2011;

15% effective January 1, 2012.

Generally, provinces and territories have two rates for corporate income tax – a lower rate and a higher rate.

Lower rate

The lower rate applies to either:

the income eligible for the federal small business deduction; or

the income based on limits established by the particular province or territory.

Higher rate

The higher rate applies to all other taxable income.

British Columbia corporate tax for lower rate is 2.5% and for higher rate is 10.5% effective January 1, 2010.