Income Tax

by admin

Comments Off on 2011 USA Income Tax Filing Deadline Is April 17, 2012

2011 USA Income Tax Filing Deadline Is April 17, 2012

USA income tax filing deadline is approaching soon. The Internal Revenue Service opened the 2012 tax filing season to report taxpayers’ 2011 income and pay taxes by announcing that taxpayers have until April 17 to file their tax returns which is just about a week away.

Taxpayers will have until Tuesday, April 17, to file their 2011 tax returns and pay any tax due because April 15 falls on a Sunday, and Emancipation Day, a holiday observed in the District of Columbia, falls this year on Monday, April 16. According to federal law, District of Columbia holidays impact tax deadlines in the same way that federal holidays do; therefore, all taxpayers will have two extra days to file this year. Taxpayers requesting an extension will have until Oct. 15 to file their 2012 tax returns.

The IRS expects to receive more than 144 million individual tax returns this year, with most of those being filed by the April 17 deadline.

Keep in mind this tax filing deadline is applicable to USA citizens, green card holders living in the USA and its territories.

So, if you do not live in the USA and one of its territories, don’t get panicked with the approaching USA tax filing deadline.

USA citizens and resident aliens living in a foreign country (off shore), get an automatic extension to report their 2011 income tax till June 15th, 2012. As always you can also file an extension to report your 2011 world wide income. Your tax filing deadline may also be affected by the tax treaty between USA and your 2011 country of residence.

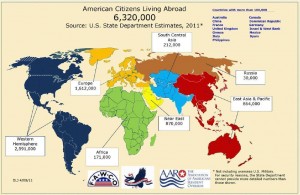

2011 U.S. State Department estimate shows that there are about 6.5 million USA citizens living off shore in different parts of the world.

Offshore Voluntary Disclosure Initiative ( IRS OVDI) of 2012 is initiated to make offshore USA citizens to comply with the USA income tax law. USA citizens living abroad do not report their world wide income to the IRS, mostly out of ignorance.

But last year IRS, had taken special media outreach project to inform off shore USA citizens about the tax law of reporting their world wide income. Ignorance of the law is not an excuse. Off shore USA citizens not only have to file their world wide income, they also need to report their off shore bank, investment account and their interest in any other financial assets each year. Failure to do so could be punishable by $10,000 per account not reported to IRS.

It is important to take advantage of the income tax treaty between USA and your foreign country of residence when you are filing your off shore income tax return to the IRS. Off shore USA citizens tax return is complicated and to minimize your tax and mistakes you should look to get help from a qualified USA tax expert. Enrolling a qualified cross border income tax expert for your USA tax return will help you to minimize your taxes and stress down the road.