You Will Fall In Love Too!

One of the biggest stress of our life in North America is making enough money and keeping/enjoying the money we make.

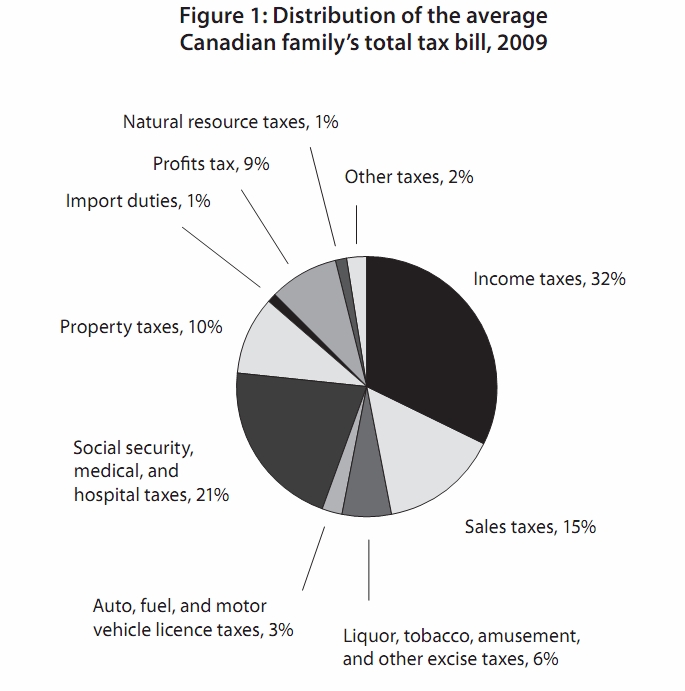

In Canada, we pay 67 types of taxes. Fraser Institute survey shows, average Canadians hand over 42% of their income to the Government.

We pay tax in many forms.

Direct Tax (HST, Income Tax)

Indirect Tax (Custom, Excise Tax)

Embedded tax (Gasoline Tax)

From the chart above you can see 68% of taxes are indirect and embedded tax. Only 32% tax is direct tax. We all must pay the indirect and embedded tax. The only tax we can plan and decide how much to pay is the direct tax.

"Super Sam" is the man who can help plan, reduce, eliminate your direct income tax.

See, if you are an employee, you pay tax on your Gross Income which is taken away at source. You don't even see the money, until next year, when you file your tax return and if you are lucky, you will get few dollars back. Otherwise you will pay 40% of your income in taxes.

But if you are self employed or a business owner, you do not pay any tax in advance. You report your income after the year end and pay tax, only on "NET INCOME".

And

if your "NET INCOME" is small enough, you might qualify to get free

money from the Government.

"HOW ABOUT THAT?"

"Super Sam" will take the biggest stress off of your mind. 100% Guaranteed."

It is utterly deceiving when, I hear that doing tax is easy. North American (Canada/USA) tax system is one of the most complex tax system in the world with over a 1,000 pages of complex tax codes that even Einestine could not grasp.

Canada Revenue Agency(CRA) has over 50,000 employees on their payroll and their only job is to collect the most amount of taxes from ordinary people like you and me. If they say, otherwise, they are lying.

nCRA's job is to take as much tax money from you as possible.

nCRA charges daily interest on Tax debt, which double in every seven years.

nCRA collection policy push thousands of people into bankruptcy every year

nCRA can Seize RSP, change your tax return to demand more Tax, Garnish Wage, put liens on Properties, freeze bank accounts, contact your clients. They have unlimited access to your personal confidential information.

nCRA follows strict deadline for tax payers, they don’t have any deadline to take actions.

nCRA Charges penalty and interest if you file tax return late.

nIf you don’t file return, CRA will decide how much you owe and send you the bill.

nCRA makes mistakes all

the time, knowing you can’t fight it.

CRA files criminal charges against tax

payers every week, for not

filing tax returns

Tax Payers, who have worked with "Super Sam" has fallen in love with him.

He has defended honourable tax payers from:

1. Fake CRA charges of tax evasion

2. Stopped additional assessment of taxes in thousands of dollars

3. Filed 15 years of past taxes for his clients without any conviction or fines.

4. Defended clients in Audit process.

5. Supported clients in GST, PST, HST and Payroll Audits.

6. Reviewed and amended past tax returns to reduce tax.

7. Recovered paid taxes when business suffered a loss

8. Secured Federal and Provincial Grants for his business clients.

among many other tax and business related services he provides for his clients.

Super Sam on InkwellSuper Sam on Network Hub

If you are stressed out about money, your business or your taxes get "Super Sam" in your team.

If you are not happy about the amount of taxes you are paying, Call "Super Sam". He will protect you from the "Taxman".

If you have a burning question about your tax, Call "Super Sam" for a free consultation.

Contact him direct

604-764-7864

(Privacy and Confidentiality Guaranteed)

"You have nothing to lose, but to fall in love with "Super Sam" like I did!"